Are companies that effectively distribute value amongst all stakeholders more resilient? Do companies that integrate social and environmental impacts into their strategy create long term value?

« These are some of the tricky questions that we faced while experimenting with the brand new strategic tool we’ve created at Fabernovel: the Value Wheel. To help us find an answer to these questions and to further experiment with the model, we have had the chance to work closely with five students from Ecole Polytechnique (Noor Fikree, Georges Hachem, Jerome Jalkh, Thomas Maaza and Dimitra Spyratou) through a collaboration with Manadvise.” Claudia Del Prado & Elisa Rimbano, Senior Project Managers at Fabernovel.

What is the Value Wheel?

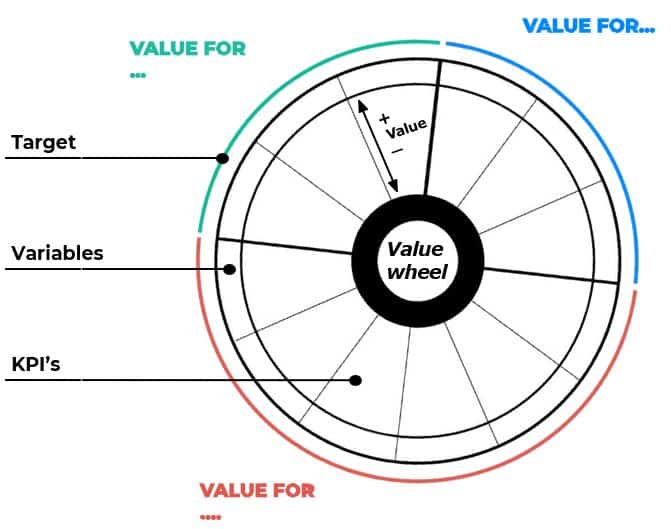

The Value Wheel is a framework that facilitates strategic decision-making by integrating all stakeholders of a company and enabling a balanced distribution amongst economic and social & environmental value.

The Value Wheel is an aggregation of multiple assessment topics allowing companies to evaluate and prioritize their projects through the 3 following dimensions:

- Stakeholders (exple.: company, planet, society…)

- Objectives (exple.: financial, renewable, employees …)

- Associated KPIs and KVIs to each variable.

Interested in the Value Wheel ? Read more about it here

Challenging the Value Wheel through five case studies

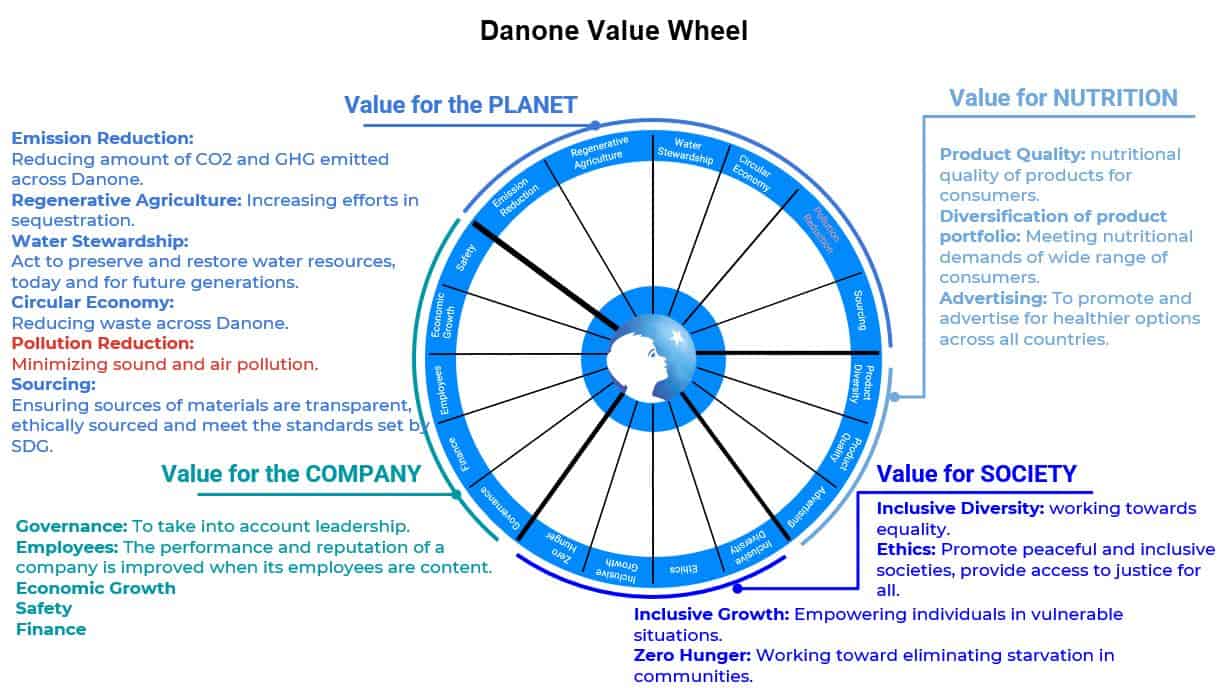

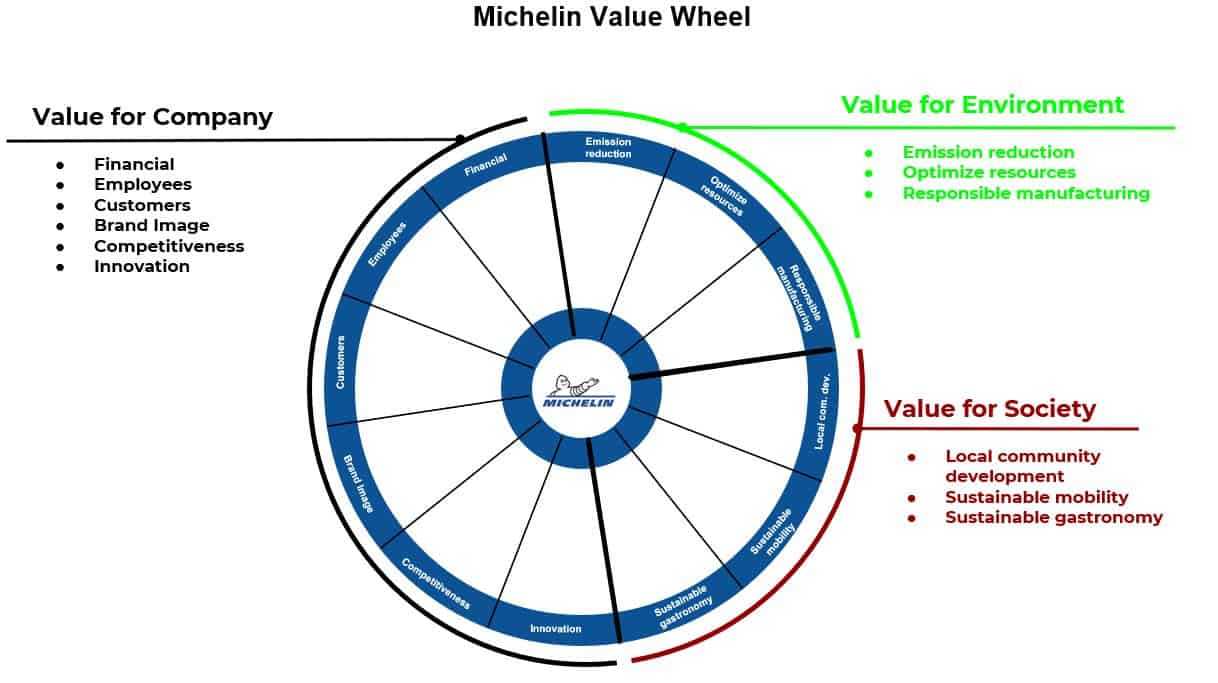

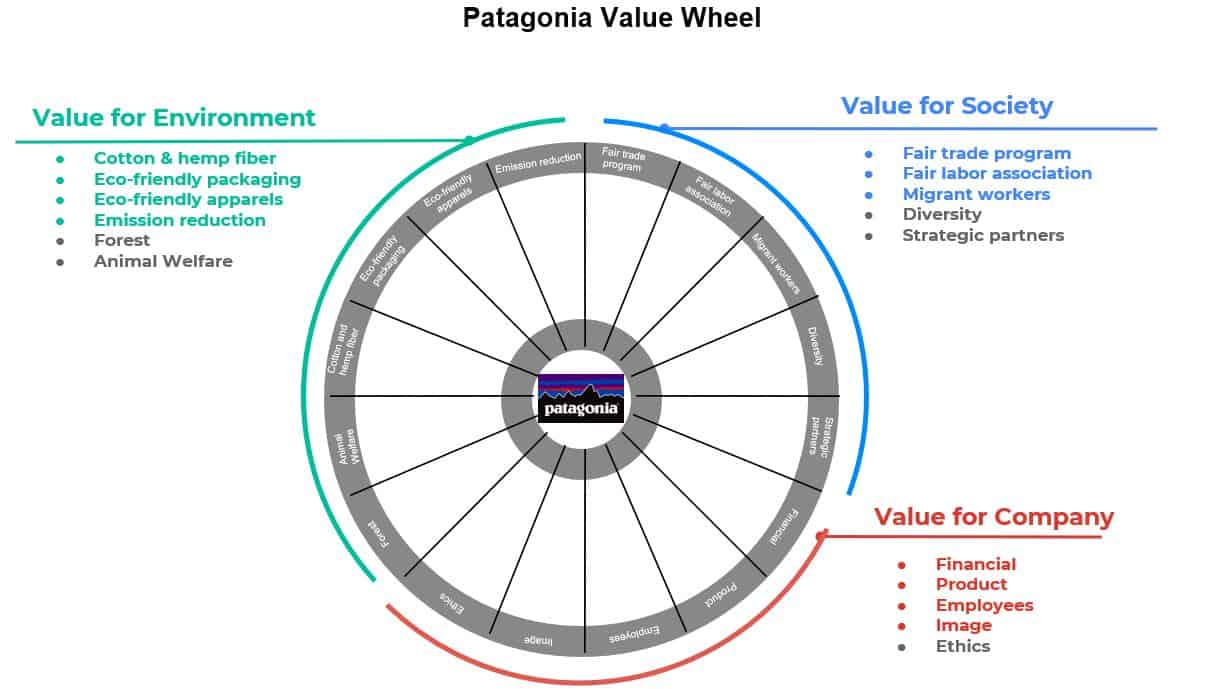

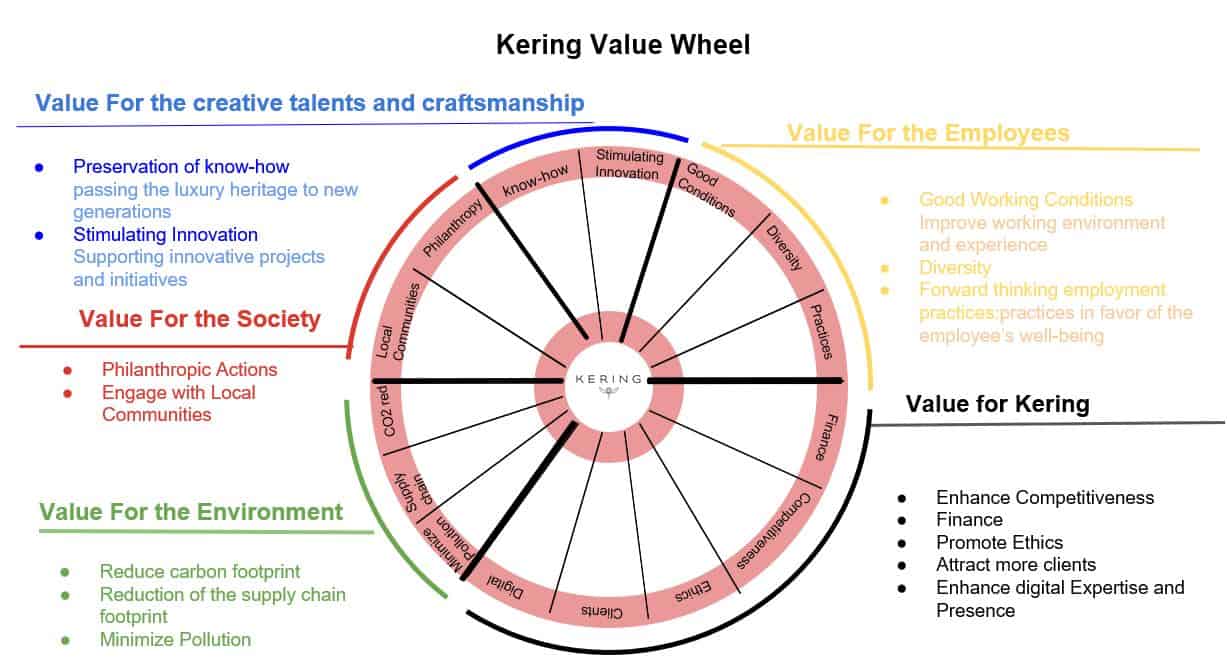

Each student took on the task of studying one company among Danone, Kering, Michelin, Patagonia and Schneider Electric. Their approach involved three stages: define, play and conclude. To ensure consistency, they frequently held group meetings to check and challenge each other’s analyses, in addition to weekly meetings with Fabernovel and Manadvise experts.

They started by defining the value wheel and gathering information about each selected company. To have the most neutral, objective and similar perspective for each company, all the resources they used were open access on the net (press releases, financial reports and ESG reports) rather than interviews with subjective stakeholders. The collected data enabled them to define the stakeholders, objectives and KPIs to build the value wheel.

The second stage of the project was to play the wheel and apply it to business cases within the selected companies: identifying the most relevant business cases and evaluating their “value creation profiles”. However, they were sometimes confronted with difficulties to measure the impact of certain initiatives when they are not easily quantifiable.

Finally, in the third and last stage they were able to draw conclusions from the results they obtained by giving us feedback and comments on their significant findings. In particular, they observed that value creation for the defined stakeholders varied significantly from one business case to another. We were able to confirm our expectation: it is necessary to adapt the tool for big companies that have different business lines.

“Working with Fabernovel was amazing! Claudia del Prado and Elisa Rimbano were lovely and very helpful with their constructive feedback, they were very understanding. It was a very valuable exercise and will be useful for me in the future!” – Thomas Maaza, Student at Ecole Polytechnique.

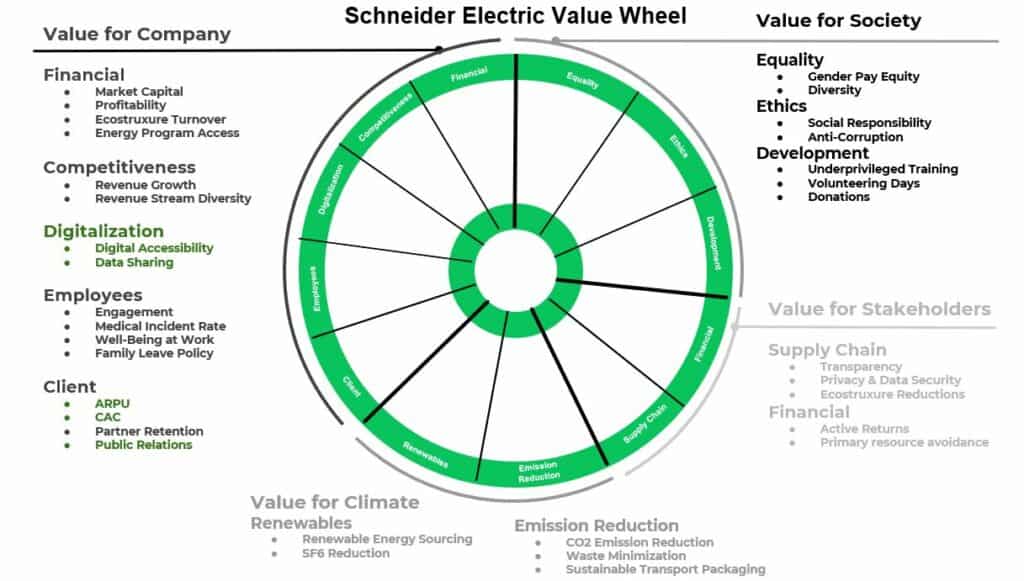

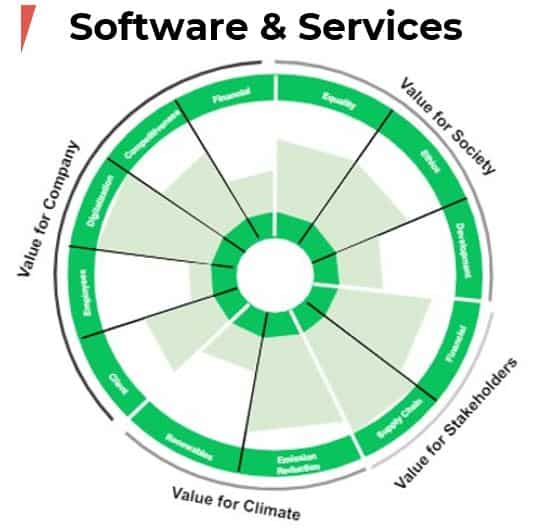

The case of Schneider Electric: the CSCS value model for Company, Society, Climate & Stakeholders

Let’s have a closer look at the Value Wheel of Schneider Electric the students built. The company is leading the digital transformation of energy management and automation in homes, buildings, data centers, infrastructure and industries.

Schneider Electric is the perfect example for playing the Value Wheel since it aims to contribute to a world where we can all achieve more in a sustainable manner. The company reaches this by helping people make the most out of the available energy.

The value creation of Schneider Electric is composed of four main stakeholders:

- value for company,

- value for society,

- value for climate and

- value for stakeholders.

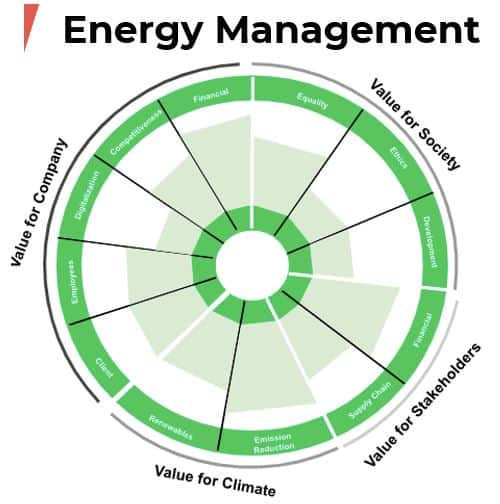

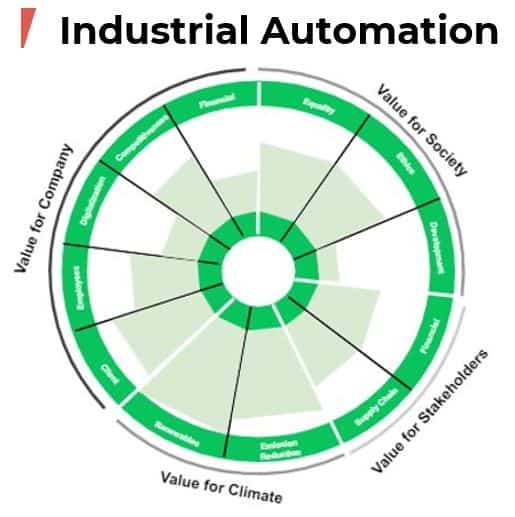

Within the company, activities are split into three main business cases: energy management, industrial automation and software and services. These business sectors focus on different areas of value creation. Indeed, the energy management sector is particularly valuable for the company and especially for its finance. Indeed, energy management generates approximately 75% of the company’s revenue. The main focus of the industrial automation sector lays on the value for climate with especially high impact on renewables. In the meantime, the software and services sector maximises value for Schneider Electric in terms of digitalisation and in terms of supply chain.

Key takeaways

Bottom line, this challenge has been very beneficial for the company and the students. For the latter, it enabled them to confront the difficult reality of measuring the impact of a company on its ecosystem. As for Fabernovel, the project has been key to challenge the model and draw operational conclusions :

- Lack of transparency and disclosure: there is still much information on non-financial KPIs that companies don’t make public, and so obtaining some information to build the value wheels was not easy.

- Infinity of Value Wheels: Each company has its own value wheel. Each company integrates social and environmental impact in a different way, although most focus on similar stakeholders (Planet, Society, Talents). We also found that planet indicators are usually the same from one company to another.

- Complexity of deep change within organizations: Integrating a full stakeholder value creation vision “by design” is complex and implies multiple and profound changes in the organisation, from its strategy to its operational model. However, starting with the vision and strategy is key to start paving the way, and to start measuring things you would otherwise not

- Difficulty of impact measurement: The Value Wheel is a very useful tool for strategic projection and evaluation but measuring remains complex for various reasons (harmonization of metrics, problems of reference).